Early Termination Payments in Xero

When you terminate an employee, you have to make an adjustment on the amount of tax paid. The Early Termination Payment (ETP) is taxed at a different rate depending on the age and length of employment. It could be between 16.5% and 46.5%.

Please see the Criteria for Whole of Income Cap. Please see the Preservation Age table. The amount payable should be checked with your Accountant.

There is a limit to the amount of ETP that qualifies for the lower rate of tax (called the cap).

Choose a reason for the termination from the list below:

- Resignation

- Dismissal

- Death

- Early retirement

- Invalidity

- Redundancy

- Retirement

ETP Payments can include payment for :

- Unused Sick Leave, RDOs, Long Service Leave and Holiday.

- Payment in lieu of Notice

- Redundancy Pay

XERO Payrun for a Terminated Employee

- Please calculate the ETP payment amount and tax rate with the following tool: Australian ETP – Termination Payout Calculator

- Check the employees Accrued Sick and Holiday pay.

- Add a Leave Application for these amounts in the Employee’s Leave Tab (Employees + Person + Leave + Add Leave Application)

- Create an Unscheduled PayRun and click into the terminated employee.

- Click the Add Tax Line button, enter a description, press Enter then type a negative number that will ensure the tax is calculated to the correct amount determined with the tool.

Payments Summaries (Group Certificates)

At the end of the year when you process the Payments Summaries (Group Certificates) you enter a lump sum amounts for each terminated employee. Once you are in the Payment Summary :

Click on the Lump Sum column header to edit lump sum payment amounts.

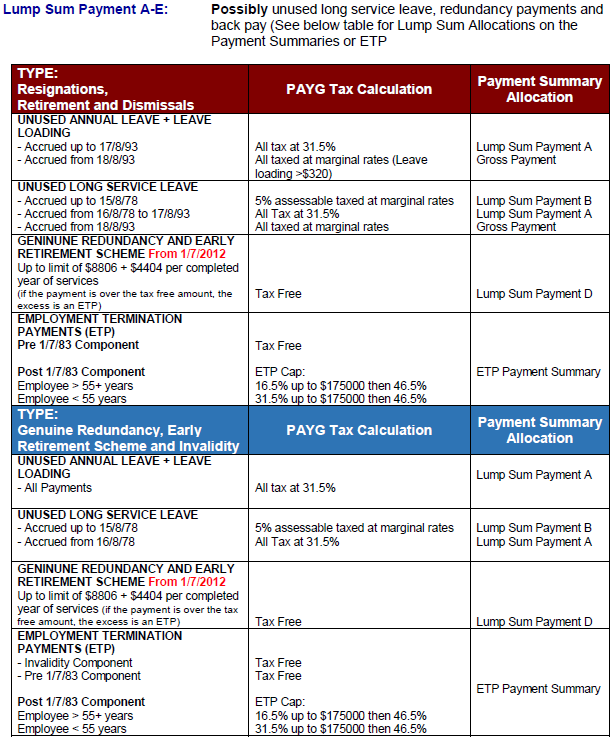

Enter the amounts to the applicable lump sum option (A, B, D or E).

For lump sum A amounts, you must apply a termination type: R or T.

R – payment for genuine redundancy, invalidity or under an early retirement scheme

T – payment for any other reason.

ETP Summary

The following data is from the ICB.