New improved MYOB to Xero conversions!

Note that these features do not currently apply to Reckon files.

We are very excited to share our updated conversion service and website. It is a huge step forward in getting even more complete data into Xero.

Even better is the fact that everyone we can convert can now convert from MYOB to Xero for free. After the great uptake of the free conversion service by Xero partners, businesses can now use the service directly. Our deep thanks go to Xero for making this possible with their sponsorship.

Our conversion service also includes a whole pile of new stuff including eliminating some of the MYOB headaches that come from hidden data. The only thing we don’t do is make your morning coffee!

In a nutshell:

- New simple conversion process

- Detailed history for current & previous financial years

- Monthly comparative balances to go back even further

- Conversion review for an even better Xero set up

- Pre-conversion tidy up of MYOB data

- Xero Action Checklist

New simple conversion process

The process is so simple – our software does the grunt work for you.

We will get in touch when we need your input and when the conversion is complete.

Step 1 – File Analysis

Load your MYOB file. We analyse the data in the file, including what financial year it is in and how far back the data goes.

Step 2 – Select Service

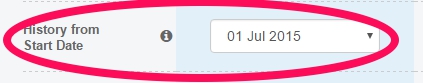

Choose from the service options available to you. Based on the MYOB file analysis you can select transactional history start date and additional comparative balances for more comprehensive business information in Xero.

Step 3 – Review Details

Tell us how you want the data to be treated in Xero for bank account types, and custom tax codes if you have them.

Step 4 – Complete

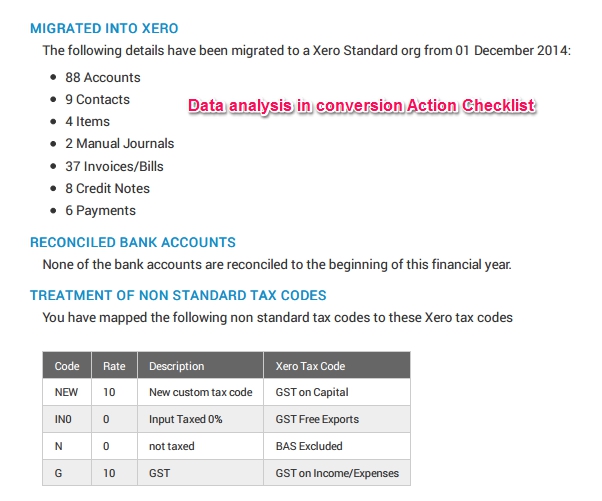

Our promise remains that you receive your Xero subscription and customised conversion Action Checklist within 3 business days. However we had a look at how quickly we deliver and over 80% of conversion are completed the next day.

Detailed history for the current & previous financial year

Xero has extended the sponsorship to cover an additional year of history. This means that free conversions can start from the previous financial year (FY) and give you heaps more data to refer back to.

Our software will read your MYOB file and determine the earliest starting point for transactional history and give you the choice of how much detailed data to include. Where your transactional history can start depends on the FY setting in your MYOB file. For example if the MYOB file is in the current FY then we can go back as far as the start of the current FY for transactional history.

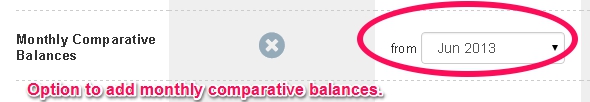

Monthly comparative balances to go back even further

Even if the MYOB file has been rolled, we can access monthly comparative data back further in the MYOB file. The monthly comparative balances apply to both P&L and balance sheet accounts. This is an optional premium service which you can add to the free conversion.

This is ideal for situations where you want to track business performance over a period of time or understand seasonality.

Conversion review for an even better Xero set up

Prior to conversion you can decide how the data will be treated in Xero. This ensures it will work according to Xero’s accounting rules.

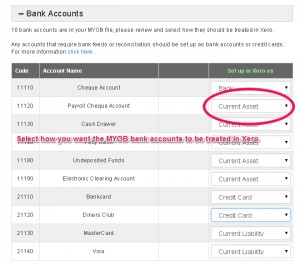

Bank account types

In most cases only bank accounts that require a bank feed or reconciliation should be set as a bank or credit card in Xero. MYOB often has accounts incorrectly marked as bank, which is very time consuming to change in Xero.

As part of the conversion process, we show you which accounts are “bank” in MYOB and to which date they are reconciled. That way it is easy for you to select the correct bank account types before the conversion.

We recommend that anything that requires a bank feed and reconciliation be set as a bank or credit card and everything else as asset/liability so that you can journal to them.

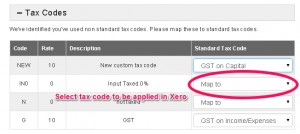

Custom tax codes

Custom tax codes

Xero has a set list of tax codes that flow through to the BAS report. If the MYOB file contains tax codes other than what Xero permits we will ask you to set the tax codes to how they should appear in Xero.

If relevant to you, this will appear along with the bank account mapping step.

Tidy up of MYOB data for free

This is where it gets really exciting.

We actually fix up some of the hidden ‘nasties’ that might be in the MYOB file so you don’t have to deal with them in Xero. Our conversion service aims to address some of the more common issues we have encountered. These fixes are free as well, thanks to the Xero sponsorship.

If any of the following apply to your conversion we will advise as part of your conversion Action Checklist.

Deposits Against Orders

MYOB files with deposits against orders cannot easily be converted into Xero.

We used to warn you and ask you to fix this in MYOB before starting the conversion again. Now, we automatically turn these orders with deposits into future dated invoices/bills so that the conversion becomes even smoother for you.

Multiple use of Accounts Receivable/Accounts Payable

If the trade debtor and/or trade creditor account(s) have been used as a linked account for something else our conversions used to fail. Trade debtors and trade creditors should only be used once within the linked accounts.

Now we fix this in MYOB prior to conversion.

Tax codes other than 0 or 10%

Xero works better by just using the standard tax codes. If you have used tax codes with a rate other than 0 and 10% but pure GST (e.g. 5.5% for long term rental) we split all the transaction lines into a GST component (at 10%) and a GST free component to get correct BAS reporting happening in Xero.

Order received but not invoiced

A MYOB file cannot be converted if it contains open orders with items received, but no invoice raised. This is because an item’s value cannot be determined until it is a bill.

If such transactions are in your MYOB file we will address them prior to conversion.

Multi currency

Multi currency used to be excluded from the free Xero sponsored conversions. Now even those are included with the exception of a file that includes both multi currency and inventory. By default we only bring in data from the start of the current month for these types of files.

Pre-conversion fixes now available

Previously if we encountered certain MYOB files we were unable to convert. Now with the assistance of our recently acquired Australian based conversion Partner we can do the following for a small fee.

We manage the entire process and only invoice you if we are successful in completing the conversion to Xero. You will be asked for approval before we proceed.

Please contact us if you would like to discuss.

Macintosh

We are unable to read the data from MYOB AccountEdge Mac files.

We hold licensed software which we can use to transform the data into Windows compatible format for a fee.

Verification errors

Sometimes database errors in MYOB don’t allow us to use our cloud based conversion tool. A good indicator that this might be the case is if you cannot successfully run the verification process in MYOB.

If you cannot fix the Verify errors yourself our conversion partner can give it a go. On most occasions the fix is successful and we can continue with the conversion.

Xero Action Checklist

To make it even easier for you and your clients to get started in Xero you receive a customer Xero Action Checklist at the end of a conversion. It outlines exactly what steps you need to take to complete the conversion.

We have reworked it to make it even more useful and focused on the things that are relevant to you.

Wow – that’s a lot!

Yes there are quite a few changes to our service but the great news is that you don’t have to worry about remembering any of this as it will be all displayed on our website as you navigate through the conversion.

If you have any questions our Knowledge Base & Support Center is just a click away for an immediate answer to your question.

I hope that you enjoy the new conversion experience and would love to hear from you what you think – just pop in a comment below.

Wendy

Hi, I’m organising a MYOB conversion to Xero on 3rd Jan 2017 for one of our client – can you confirm that your office will be open for this conversion on 3rd January 2017 and roughly how long it will take? We will make sure the MYOB file is clean prior to the conversion. Thanks.

Hi Julius,

Thank-you for checking in ahead of time.

There is a good chance that the office will be closed on this date though we have not made a decision on that as yet. If the office is closed the only implication is that you cannot contact us to get questions answered real-time via chat or telephone. MYOB conversion turnaround will continue to be 3 business days, Reckon 5 business days, and we will endeavour to answer any e-mails within 24 hours.

Yours, Wendy